Woolworths and Coles have long dominated and shaped how Australians shop at the supermarket. However, in recent years, the German chain Aldi has challenged the duopoly and gained favour with shoppers.

Brand tracking platform, Tracksuit, recently put supermarket preferences under the microscope in its inaugural ‘Brand Map of Australia’ survey to find out where shoppers’ loyalty lies.

Tracksuit’s CEO and Co-Founder, Connor Archbold spoke to Mediaweek about the impact of price and loyalty, the power of branding and emotional connection in campaigns and the market disruption by niche supermarkets.

Connor Archbold

The impact of price and loyalty

For Archbold, it’s no surprise Woolworths and Coles claimed the top spots purely because of the number of supermarkets around the country, despite the high cost of living.

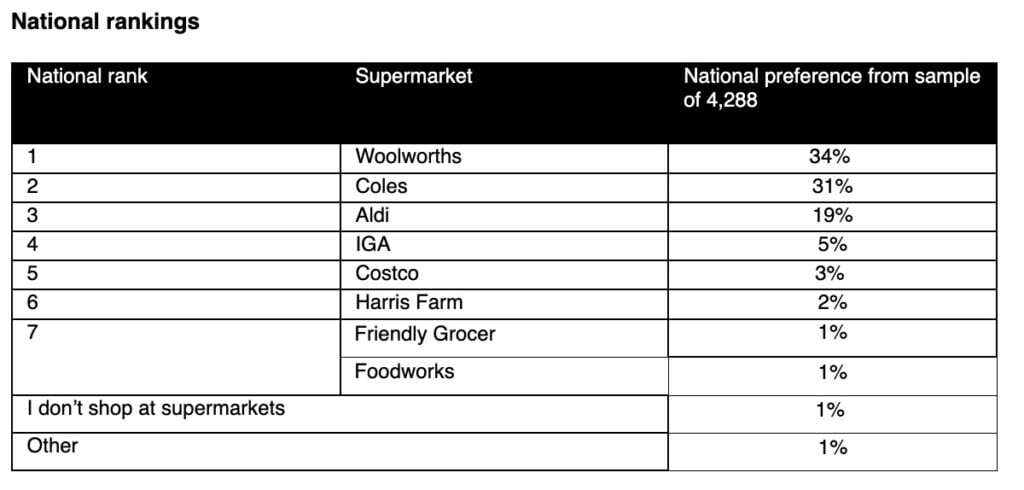

The survey of over 4,200 Australians revealed Woolworths as the nationally preferred supermarket in Australia with shoppers (34%). Following in second was rival Coles at 31%, but state-by-state findings found Coles led in Victoria at 35%.

“Distribution is king when it comes to awareness and consideration and then it flows through to preference. For years they’ve been both competing on the affordability messaging, so does Aldi but they have less presence.”

Rounding out the top three preferred was Aldi with 19%. Archbold highlighted Aldi’s growing rise in preference was surprising despite the challenger brand having fewer stores and smaller distribution compared to the supermarket giants.

The increased cost of living has put pressure on consumers to rethink how and where they do their groceries, but Woolworths and Coles have been successful in asserting attention.

“Woolies have done well with the announcement it slashed the cost of the 400 essential items because it seemed that Australians were viewing Coles as the cheaper of the two.

“Aldi, I feel, do well with their private label and its work when tied with humour and emotional connection.”

The power of branding and emotional connection in campaigns

Tracksuit’s survey reported Woolworths as the preferred supermarket across NSW, Queensland, South Australia and Western Australia, and with younger (18 to 34-year-olds) and older (over 55-year-olds) age groups.

Archbold said the battle between Woolworths and Coles has been fierce but that the former has recently run campaigns that are more “top of mind at the moment.”

“They (Woolworths) have been the ‘Today’s Fresh Food People’ since 2021, and that’s just building on their long-term campaign. That consistency is important and stays in the minds of folks. So, if you’re doing fresh food and you’re doing affordability, that might be striking a chord.”

He also noted the supermarket’s collaboration with the Australian Olympic and Paralympic athletes for the 2024 Paris Games on the ‘Fresh fuels the best in all of us’ campaign as emotionally appealing that consumers support.

“It’s that emotional advertising that seems to help win over hearts and minds of folks everywhere.”

Aldi employs humour in its advertising to drive its messaging and has proven to be successful in scaling its business.

Archbold noted that Tracksuits’ recent report, Entertain or Die, highlighted that brands using humour or other entertaining values in their marketing are much more effective in actually creating awareness, consideration and preference.

“That’s very smart of Aldi to appeal to people’s humour and that might be helping them come up into that challenger brand category.”

“They are punching above their weight. I think they have an outsized preference share because of their fantastic marketing.”

How does Coles fare in contrast to its rivals?

“It’s such a tight race and it’s hard to say that Coles is massively behind. They are running relatively good emotional campaigns, not humorous.

Archbold said the supermarket’s ‘Good things happening at Coles’ campaign highlights low prices, its community involvement, how they’re helping out everyday Australians, and its ‘Great lengths for Aussie Dairy’ partnership with farmers.

“You’re seeing Coles’ appeal to the everyday Australians and you’re seeing Woolies go with ‘fresh’, and both of them are coming through with the affordability and trying to help everyone get through these tough times.”

The market disruption by niche supermarkets

With Woolworths, Coles and Aldi in podium positions in the Tracksuits findings, the survey also showed how smaller players in the supermarket sector compare.

IGA, Harris Farm, Friendly Grocer and Foodworks ranked significantly lower in national preference, but the report noted younger consumers (18-34) are more likely to prefer these brands compared to the national average.

On whether the smaller players have the potential to disrupt the market, Archbold said that while boutique supermarkets are doing a good job of driving loyalty with its core demographic with specialty products, they would struggle to compete with Woolworths, Coles and Aldi.

“There are certain groups of people that choose those stores for a certain reason, and those stores can lean into those and market to those value propositions first and foremost, before expanding out of them.

American warehouse giant Costco ranked fifth in national preference with 3%, despite the small figure Archbold said its performance would be interesting to track in future surveys.

“International companies with big budgets and can compete on the core value of affordability, I think, will gain a foothold.

“Aldi will hopefully continue growing along with their footprint and distribution and I would love to see the smaller niche offer offerings grow alongside that.”

Archbold suggested that growth in the wider range of supermarkets could result in the flattening of preference instead of between two or three big companies.